BACKGROUND

WHY AND HOW DID THE 'NO RAINY-DAY' MODEL COME TO LIFE?

It all began with a bold and VERY wrong bet on the Ethereum breakout in late 2021. Of course, my bank account and my confidence took a significant hit. This humbling experience was a turning point that led me to search for a new investment approach. One that would serve as a safeguard when I found myself on the wrong side of the market. In 2021, I made the decision to step away from my job and dedicate myself fully to this quest.

Two years of relentless effort later, the No Rainy-Day Model comes to life as a fresh investment approach. The Model is a data-driven system designed to help implement a consistent and prudent speculation approach by betting on high-growth potential opportunities when they go up.

The Model is based on the combination of top fundamental research and best-in-class quant and technical signals

This newsletter takes shape to shed light on this very model. We are proud of what we have cooked up, and we're thrilled by the opportunity to drop the No Rainy-Day Model results in your inbox every week.

Our purpose is clear—to equip you with high-value, unbiased, and highly actionable insights that you can use on their own or to complement your current approach.

THE MODEL IS RIGHT FOR YOU IF ...

- You are interested in investing but feel you do not have enough time or resources to manage your portfolio effectively

- You like to sleep well at night by knowing you have a system that protects your capital from major drawdown

- You are looking to catch the BIG Money rather than the FAST Money. The content of this newsletter will not be relevant for intra-day or short-term traders

OUR PRINCIPLES

Principle 1- We can be wrong but we will NEVER stay wrong. As Warren Buffet said, the number one rule in this game is never to lose money, and rule number two is never to forget rule number one.

The future is uncertain and so, we need an approach that stands ready to confront whatever challenges lie ahead. This holds exceptional significance in today's environment, where financial and geopolitical risks are increasing and the likelihood of finding ourselves on the wrong side of a trade looms larger with each passing day.

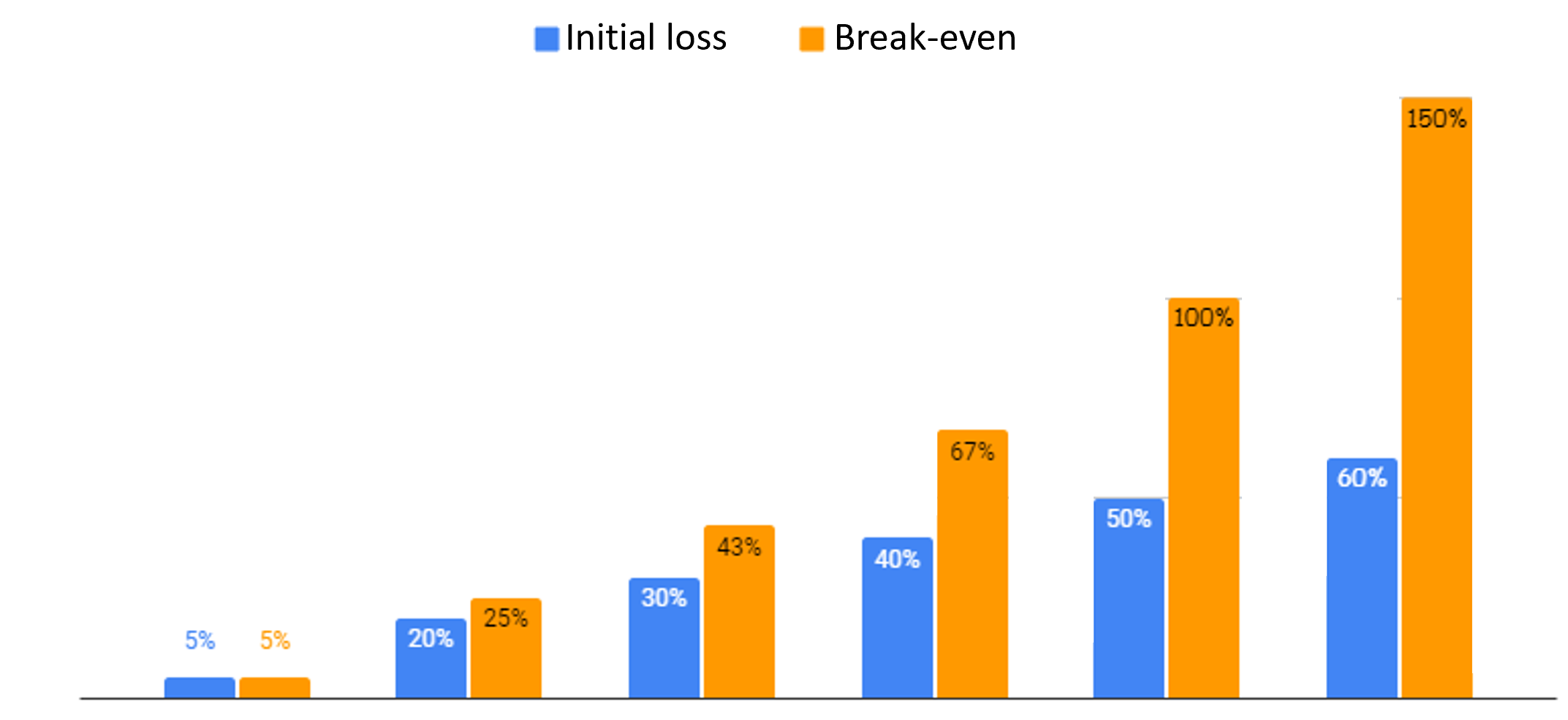

The Model's first mission is to protect the invested capital. If you are serious about building wealth, it is fundamental to avoid big losses as the bigger they get, the more difficult the road to recovery is. The mathematics of the principle are clear: recovering from a 5% loss requires a 5% gain, whereas recovering from a 50% loss demands a staggering 100% gain, a formidable task in itself.

Since the No Rainy-Day Model is a data-driven quantitative approach, you immediately know when you are wrong and can exit on time. There is no need to predict anything; it simply follows the trend.

Principle 2- Turn off short-term noise and position yourself in the mid-term to minimize operational costs and enjoy less competition

The No Rainy-Day Model flashes signals (both buy & sell) when structural market conditions change, ignoring short-term noise.

- Short-time horizons are crowded with professionals and bots, making it harder to get an edge

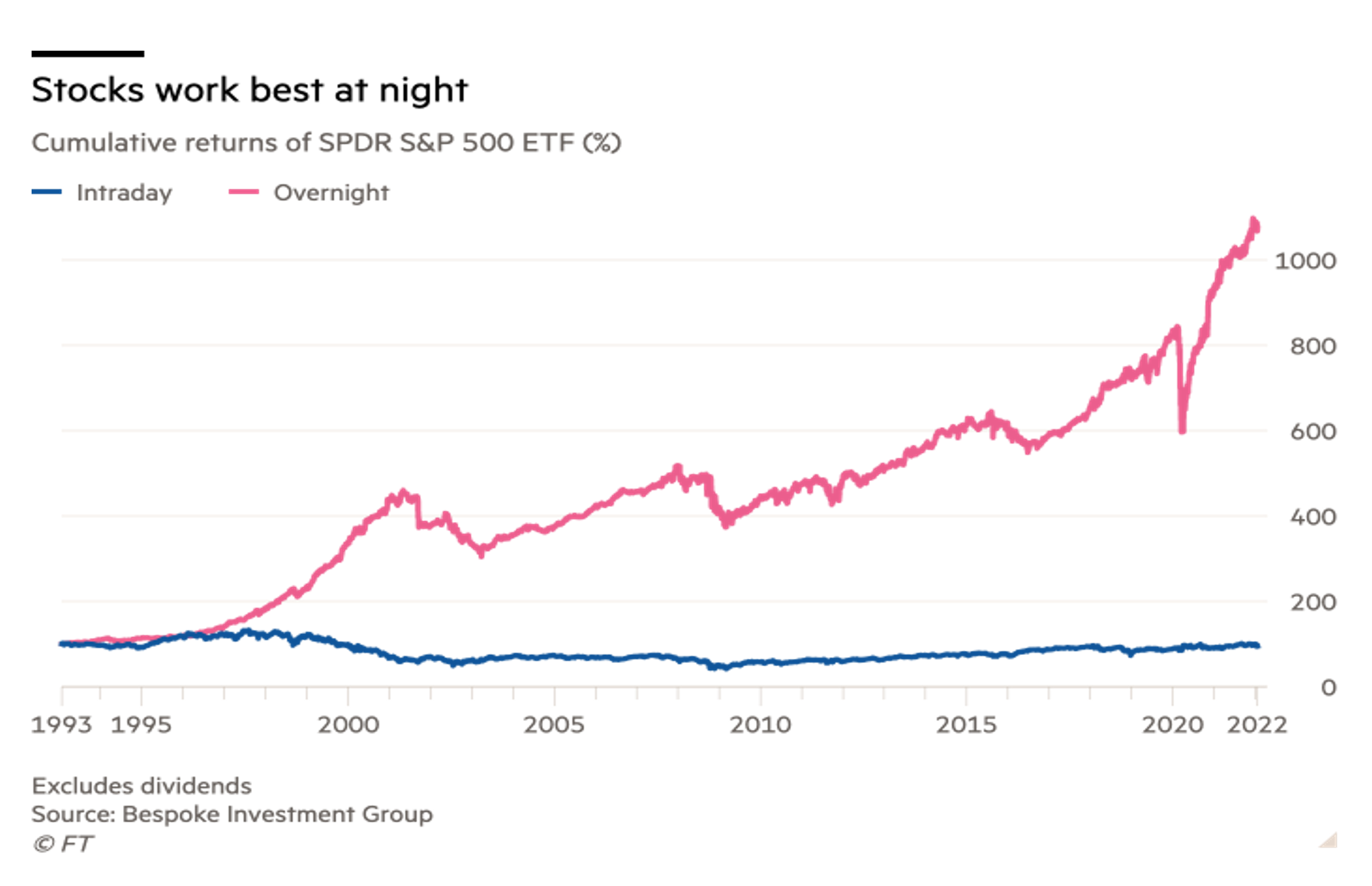

- Short-term trading is also suboptimal as healthy profits are made by letting the money sleep in the positions overnight.

Principle 3- Cover a broad range of high-growth potential opportunities to find trading ideas no matter what the macro context is:

- Our strategy is intricately woven with the insights we get from industry and macro experts such as Luke Gromen, Raoul Pal, Ray Dalio, Goehring & Rozencwajg, Russell Napier, Beth Kindig, Lyn Alden, D, Rosenberg and others.

- They point us toward specific asset classes and sectors, primed for growth within the current macroeconomic landscape.