Weekly Update #25: Apr. 14 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

Macro:

As mentioned on Saturday in the quick market update, the week's closing was ugly and the model is signaling getting into cash. There is no change in the big-picture view mentioned in previous posts. Yes, I am still ultra-bullish mid-term on hard assets, crypto and tech as I fundamentally believe in the debasement trade, but it's time to be cautious as the dollar and rates broke out last week.

The last two weeks have had a similar taste: a global reflation trade centered on commodities with some violent market selloffs by the end of the week. The selloffs were of similar magnitude but there was a major difference to the tone this week as precious metals failed to maintain the bid into week’s end. The price action this week is a bit more hair-raising than last week’s one-day dump.

Equities:

Both the S&P500 and the Nasdaq100 broke down from their uptrend lines and are sitting just above their 50-day moving average ... but meanwhile, around 60% of individual stocks are already trading below their 50DMA.

And the model turned bearish on the indexes this week.

Digital Assets (aka crypto)

Cryptos went crashing 20%-40% in a matter of hours when we had a World War 3 scare over the weekend with Iran-Israel tension. When the news came out that the matter had been put to rest for now, markets rebounded sharply.

The good news is, that a lot of leverage has been wiped off the system. It's like ripping the band-aid off. It makes it easier for the markets to move up.

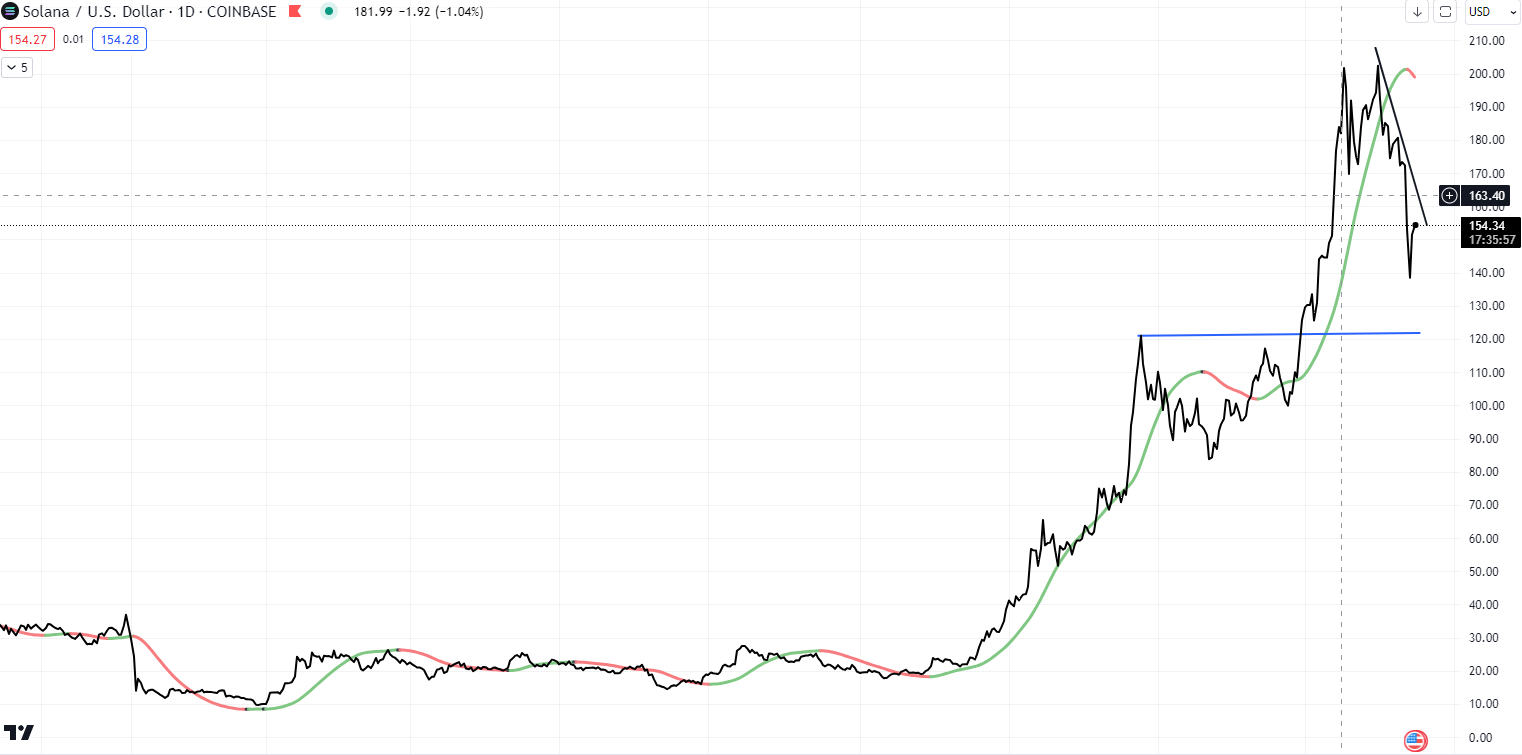

However, the model has turned bearish for now on BTC, SOL and ETH. We will be looking for opportunities to exit the positions where we have not yet been stopped out. We will sit in cash, waiting for an opportunity to get back in. Patience, I do not think it will take long but we need to let it play out. Capital preservation first.

Commodities

The model continues to be bullish on Gold, Silver and Oil.

PORTFOLIO UPDATE:

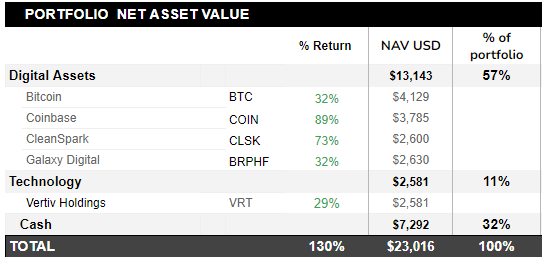

We've been stopped out in SOL and we will look for opportunities to exit BTC, CLSK and Galaxy. We will keep COIN and VRT open for now as the model continues to show bullishness on those names.

We started the portfolio with $10,000 on October 20th 2023, and NAV is now at $23,016.

LINK OF THE WEEK:

This week, we bring you a podcast a great piece from Ray Dalio, who founded and served as chief investment officer of the Bridgewaters, the world's largest hedge fund.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.