Weekly Update #20: Mar. 11 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

No change in views. The US dollar and 10-year rates sustained their downward trend for the third consecutive week.

Equities:

The model continues to be bullish on the SP500 and the Nasdaq. So bull market until further notice. However, there are still signs of exhaustion in the trend so be careful out there.

Digital Assets (aka crypto)

No change in view since last week. Trend and momentum are firmly in the bullish territory and it's buy the dip season.

Majors BTC ETH SOL have had another phenomenal weekly close. The stage is set for an all-time high on all of them. We could be getting there soon.

Bitcoin is in price discovery. It´s all-time high. What looked like a dream a few months ago, is now a reality.

Sustained BTC ETF inflows are fueling this move - for the first time was know EXACTLY why price is rising, and there's no clear end in sight to the buying. The bull run continues, and all future targets are now theoretically, as there is no resistance ahead.

Solana is also pushing through the last key area of resistance (not through yet) before the all-time high.

Commodities:

The model is bullish on Gold, Silver and Uranium.

PORTFOLIO UPDATE:

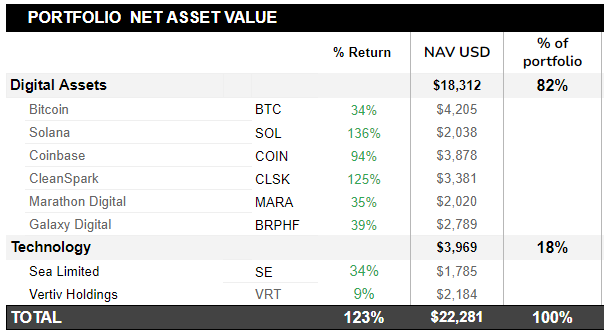

Coming to portfolio positions. There have been no entries or exits this week.

Positions continue to perform well. We started the portfolio with $10,000 on October 20th 2023, and we are 123% up since.

LINK OF THE WEEK:

This week, we bring a great chat between two trading legends from the market wizards saga.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice. WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK