Weekly Update #21: Mar. 18 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

The easing of Financial conditions paused this week with notable increases in its three components—USD, 10Y rates, and oil prices. This movement pressured all risk assets, leading equities and Bitcoin into the red.

There are, however, no signs suggesting a potential prolonged tightening of financial conditions on the horizon. The model is sending bullish signals across multiple commodities and that usually happens when the economic cycle turns up. The current ISM level and its projection shown above, confirm this hypothesis.

In the midterm, it's reasonable to expect that liquidity injections will continue, thereby supporting the upward movement of asset prices.

Equities:

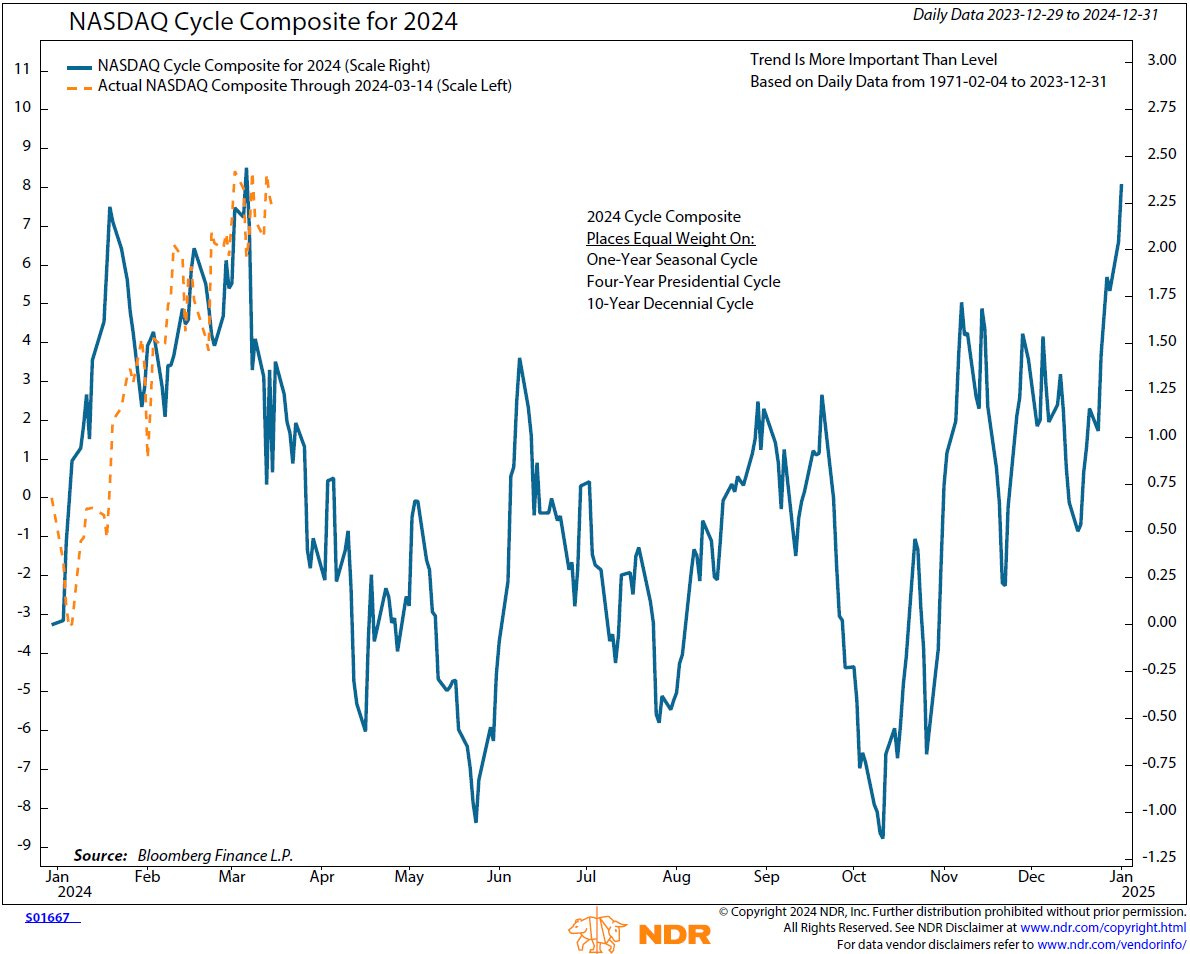

Although the model continues to be bullish on the SP500 and the Nasdaq, momentum took a negative turn this week on both indexes. Signals of trend exhaustion indicate the possibility of a significant pause or correction ahead. So, exercise caution as seasonality also flags near-term downside risk for tech.

Digital Assets (aka crypto)

in the last update, it was mentioned this:

Trend and momentum are firmly in the bullish territory and it's buy the dip season.

We got a nice dip in BTC and after the pullback markets have had a nice recovery too and closed the weekly strongly. Model longs have been performing well and continue to look good.

Solana continues to show relentless strength as mentioned in the last few updates. Since we launched the buy signal in late February, Solana has almost doubled

Commodities:

The model is long Gold, Silver, Copper, Soybeans Uranium.

The recent correction has offered a good re-entry point in the uranium trade, which we took to open a small position in our personal account.

PORTFOLIO UPDATE:

Coming to portfolio positions. Positions continue to perform well. We started the portfolio with $10,000 on October 20th 2023, and we are up 121% since.

LINK OF THE WEEK:

This week, we've selected an outstanding presentation by Raoul Pal. Don't miss out! Nobody has assembled a more compelling framework than his team.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.