Weekly Update #22: Mar. 25 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

We had an FOMC meeting last week. Despite getting CPI higher on the last two reads, there are only rate cuts on the horizon. The Fed does not seem to be in a hurry to get CPI to the 2% target anymore.

During the conference, Powell also signaled that central bank balance sheet reduction (QT) will slow... meaning more liquidity is on its way. Monstrous US government debt refinance obligations are coming due in 2024/2025 and they will need easy financial conditions and central balance sheet capacity to accommodate those treasury issuances.

We're keeping a close eye on the US Dollar Index in the near term, as it could break out of its resistance downtrend line. We do not think it´s the most probable scenario but if the breakout is confirmed, it´s gonna be a headwind for risk assets. So, stay on your toes.

Equities:

No change in views. The model continues to be bullish on the SP500 and the Nasdaq. However, we´ll exercise caution as signals of trend exhaustion continue to point to a probable short-term pause or correction ahead.

Digital Assets (aka crypto)

Cryptos had a rollercoaster of a week, dipping into Wednesday's FOMC meeting before shooting up, only to come down again!

BTC price swung between ~$60k and ~$66k. Substantial ETF outflows from Grayscale certainly impacted market movements.

Model longs continue to look good.

Commodities:

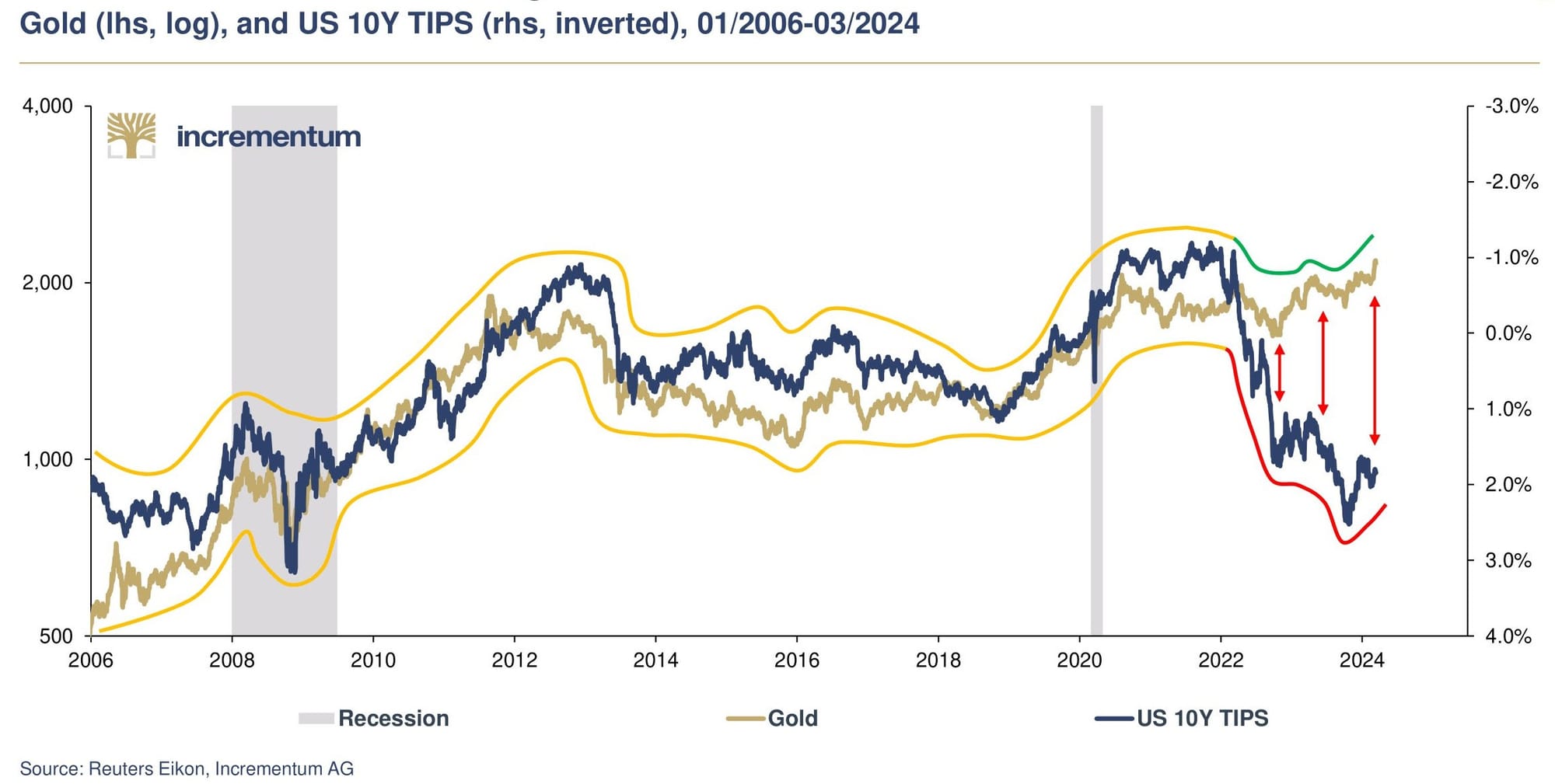

Gold has been rallying and just recently broke the $2100 key technical level. An interesting fact about gold is how it has decoupled from real interest rates. Those recent trends might be an indication that market participants are indeed starting to focus on “monetary debasement” with greater interest. As Charlie Morris said: “Dr. Copper has a PhD in economics, and is an expert on the business cycle, then gold is a professor with a Nobel Prize in monetary debasement.”

The model is bullish Gold, Silver, Copper, Soybeans and Uranium.

PORTFOLIO UPDATE:

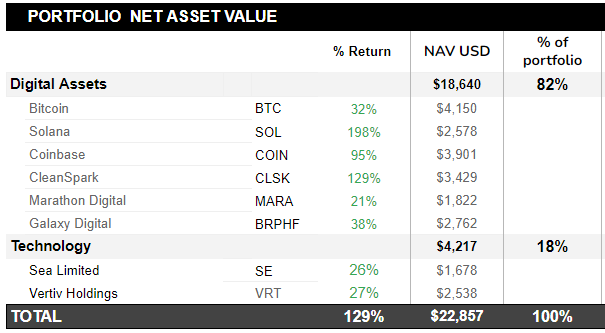

Coming to portfolio positions. Positions continue to perform well. We started the portfolio with $10,000 on October 20th 2023, and we are up 129% since.

LINK OF THE WEEK:

This week, we bring you insights from two legends of the traditional finance world who moved full crypto: Anthony Scaramucci & Dan Tapiero

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.