Weekly Update #23: Apr. 1 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

No change in views.

The Fed made it clear that the squeeze of lower growth isn´t worth the juice of bringing inflation back to 2%.

The outperformance of cyclicals vs defensives is also consistent with a significant upturn in the business cycle. We have a few leading indicators pointing to a business and liquidity cycle reacceleration.

Equities:

The S&P500 closed up +3.1% in March, placing it up 10.2% YTD (10.6% including dividends). No change in views. The model continues to be bullish on the SP500 and the Nasdaq.

Digital Assets (aka crypto)

Our bullish stance is playing out well. Markets are looking strong and momentum continues to increase. We could be looking at a continuation of explosive moves in our longs.

Bitcoin closed March at its highest level ever while most people still fade the biggest macro trend of all time, in the best-performing asset class of all time. Model longs continue to look good.

Commodities:

Gold continues its steady climb upward as central banks maintain their stimulus measures and global liquidity remains abundant.

The model continues to be bullish Gold, Silver and Oil.

PORTFOLIO UPDATE:

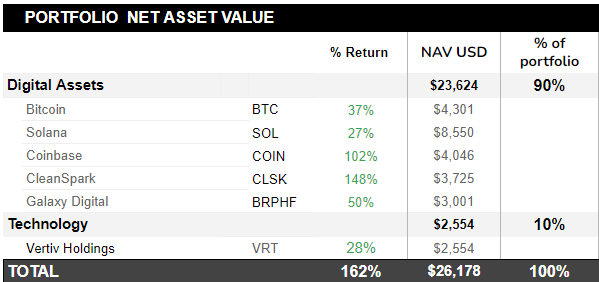

We've exit positions in MARA and SE. While there's nothing inherently wrong with these positions, we have limited capital and want to focus on the stronger names, increasing our exposure to Solana before it reaches its all-time high.

In today's world, asset correlations are high, minimizing the benefits of diversification. And so, our strategy is centered on owning the best-performing asset with the most favorable risk-adjusted returns. And the Model signals Solana as the best candidate. In line with Druckenmiller's mantra, we like to put all our eggs in one basket and closely monitor that basket's performance.

We started the portfolio with $10,000 on October 20th 2023, and we are up 162% since.

LINK OF THE WEEK:

This week, we bring you a podcast with Luke Gromen. He is a master of the treasury market and we think he is spot on with his macro picture.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.