Weekly Update #24: Apr. 7 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

Macro:

The short-term macro risk outlook has taken a turn for the worse with rates, oil and the US Dollar going higher and draining liquidity from the system this week.

But there are also some bright spots. The global manufacturing cycle is picking up. PMI increased to 50.3 in March, up from 47.8 in February. This marked the first expansion of the index after 16 months of contraction.

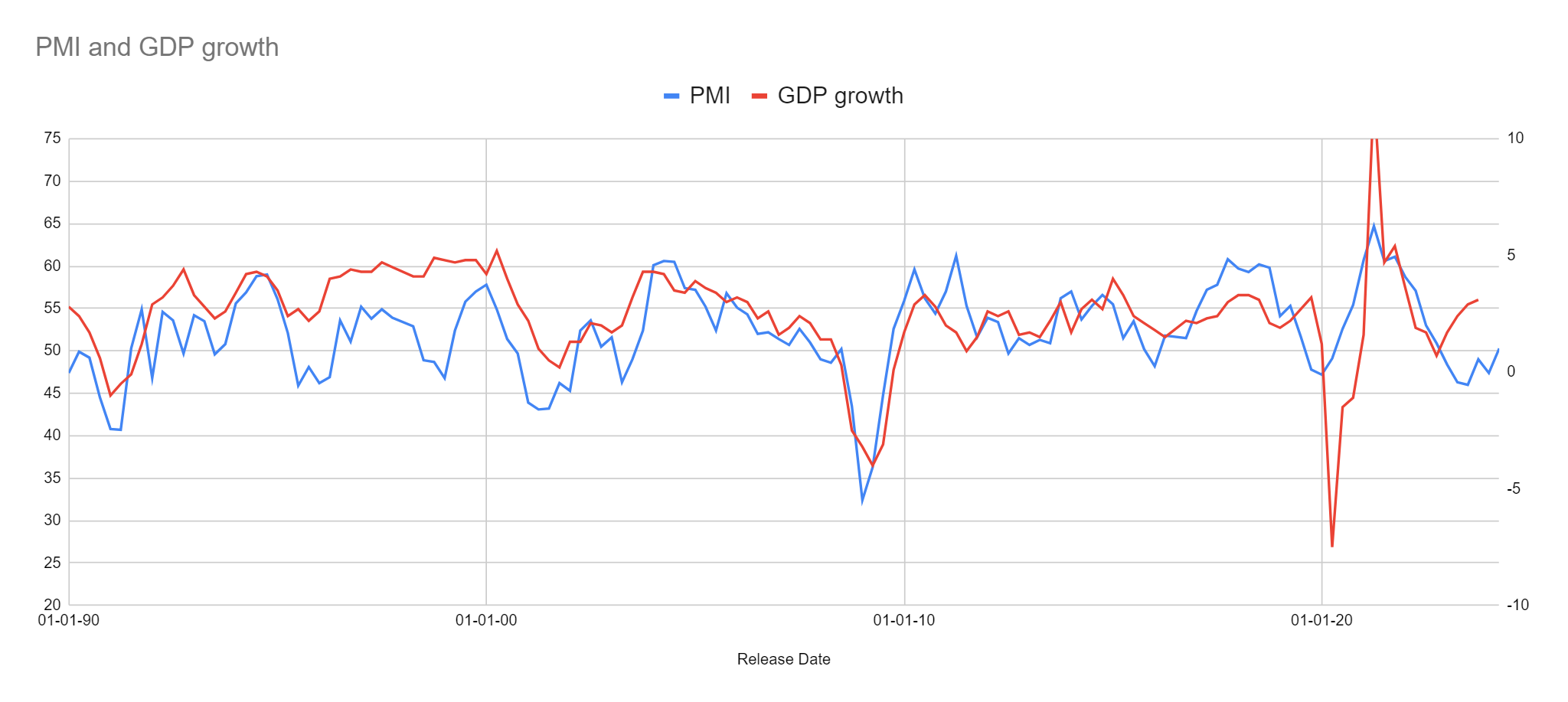

The PMI is a timely and reliable indicator of the business cycle. The following chart shows the high correlation between the ISM Composite Index and the US real GDP growth.

As you can notice, the blue curve seems to be going higher. We have a few other leading indicators pointing to a business and liquidity cycle reacceleration.

Equities:

The market was hitting ATH for the first part of the week, then Thursday happened and stocks got hammered. The major feature of the market lately has been the lack of volatility, so nobody was ready for that big of a move. It scared people, but not that much as the NASDAQ was rebounding on Friday.

Digital Assets (aka crypto)

Crypto has been chopping around this week and we will be chopping until we get the breakout. Both Bitcoin and Solana are consolidating. Consolidation is normal and necessary. It helps build base and refuel the next leg up. The stronger the base, the higher the next move and the breakout in Bitcoin seems to be happening as I am writing those lines.

Every single time BTC crosses the previous all-time high (grey horizontal line), it spends some time consolidating (pink circles) before making an exponential move up (green lines). This took place in 2013, 2017 and 2021. We are in a similar position now, not just from a price perspective but underneath the surface many of the variables that the model tracks are pointing towards it.

Be careful and don´t get shaken out from your core positions. Once the trend picks up pace, many won't get re-entries. We are likely to soon have the next explosive move upwards with BTC heading to $100k+

Commodities:

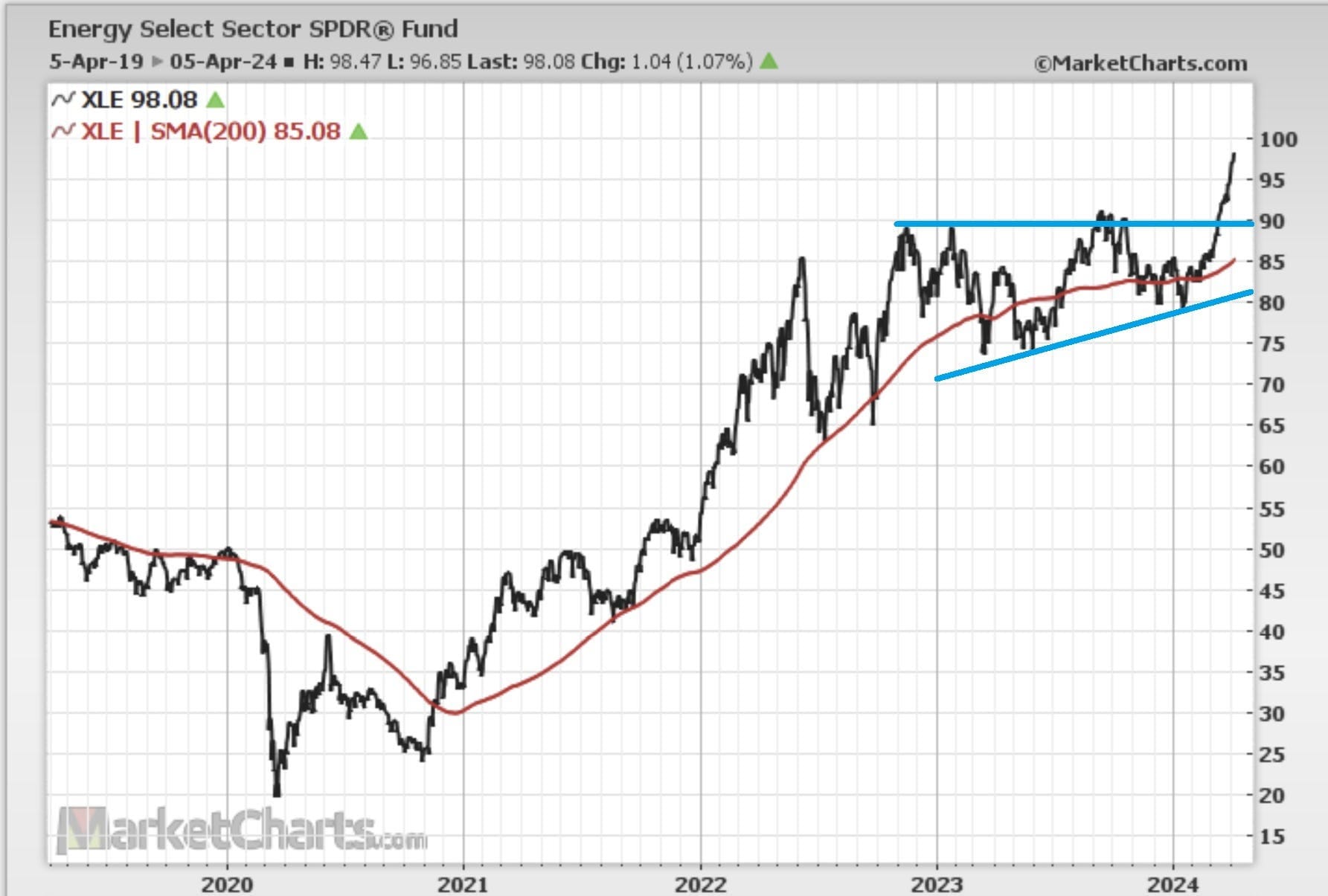

And, well, energy stocks breaking out in line with what we would expect from the business cycle. After all, global crude oil demand continues to tick higher…

The model continues to be bullish on Gold, Silver and Oil.

PORTFOLIO UPDATE:

No change in portfolio positions.

We started the portfolio with $10,000 on October 20th 2023, and we are up 142% since.

LINK OF THE WEEK:

Is the U.S. Debt Problem Imploding? Lyn Alden On 'Fiscal Spiral' and the asset classes she is most bullish on for 2024.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.