Weekly Update #30: May 20 2024

We will keep this update short as I am traveling.

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

Macro

Since 2009, markets have relied heavily on liquidity, and governments have had no choice but to supply it in any way possible. The system needs liquidity because debts are not being repaid but refinanced and refinancing requires balance sheet capacity, liquidity. Everyone has become addicted to it. As long as liquidity is available, asset prices are unlikely to drop significantly, regardless of interest rates.

After several weeks of tightening liquidity, conditions turned positive 10 days ago, driven by a weaker U.S. dollar and lower interest rates. A weaker dollar reduces the burden of U.S.-denominated debts for foreign borrowers when converted to their local currencies. The same principle applies to interest rates: lower rates decrease the cost of debt. As debts become more manageable, more money is freed up to flow into asset markets.

Our strategy is to profit from this situation while it lasts and to be ready for when it ends.

Equities:

Global stocks are rallying and the model picked the turn at the right time. Overall, the price action and momentum are consistent with that of a raging bull market.

Some areas that were left behind during the last rallies are looking good now, with big upside potential. One of those areas is China.

Digital Assets (aka crypto)

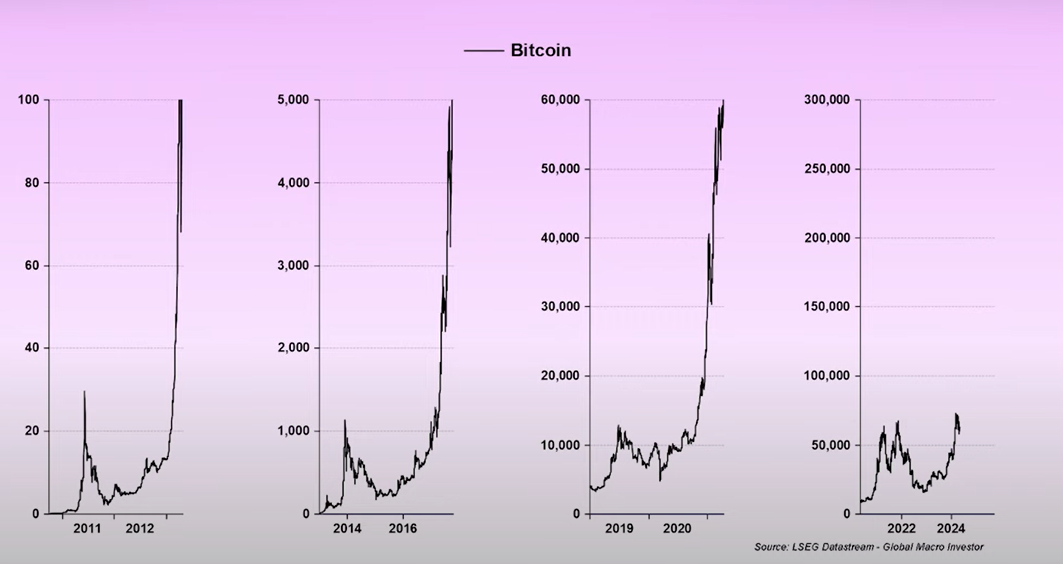

Bitcoin and Solana turned bullish. Good thing the model gave you the right playbook and timing.

However, the real action usually starts 4-6 months AFTER the halving, although history may not repeat itself, we should be prepared if it does.

Bitcoin Dominance is still at near multi-year highs, even with thousands of new coins on the market that could impact dominance. But we have very little confirmation that things are changing for now. Solana is one of the very few coins that are showing relative strength vs BTC. Ethereum is not

PORTFOLIO UPDATE:

As stated in the last updates we have open positions in crypto BTC, SOL and looking for the breakout in COIN to get back in.

In the equity front, the model is long HOOD, NVDA, MSFT, CRWD, SNOW.

The model is very bullish on Natural Gas, Uranium and Metals too.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.