Weekly Update #31: May 27 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

I would encourage everyone to read recent previous updates. Everything mentioned in there is applicable and looking to play out well.

Macro:

Not much happened last week. The US Dollar Index and the 10YR rate barely moved. Both continue to look toppy. When the downtrend is confirmed, liquidity will rise together with risk asset prices.

Equities:

NDX continued its rally and closed the week at an all-time high. The model has been and continues to be bullish on the S&P and Nasdaq.

NVDA presented another stellar performance on Thursday, in the middle of a weird wipeout in all other market areas. It´s pretty rare to have NVDA up almost 10% and the NASDAQ down because NVDA itself is 6.5% of the index and therefore a 10% rally in NVDA is a huge force on the NDX. (Thursday's heatmap is below.)

A similar picture happened yesterday. Weird. Good thing the model had been long NVDA, but still a thing to keep an eye on.

Digital Assets (aka crypto)

The model has been long for a while now and continues to be long majors BTC SOL. Higher.

After saying nothing for months, the SEC approved Ethereum spot ETFs. Many people (myself included) thought wrongly the SEC would do everything it could to find daylight between Bitcoin and ETH. Instead, it tacitly acknowledged that ETH is a commodity and not a security.

Don´t overthink it.

PORTFOLIO UPDATE:

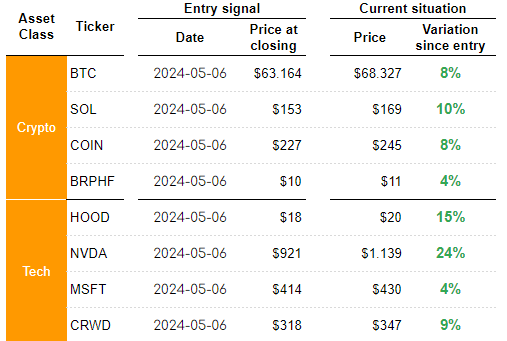

Coming to portfolio positions, the model exited yesterday SNOW. All longs are performing well.

A new entry in the AI space where the model went long yesterday is ARM.

LINK OF THE WEEK:

This week, we bring you the last piece of Raoul Pal and Julien Bittel sharing their whole framework. We love it.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.