Weekly Update #32: Jun 4 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

Macro:

After the April correction, markets moved higher in May. Just about every major asset moved higher as the US Dollar, 10Yr rates and crude oil moved lower, easing of financial conditions and pumping liquidity into the markets. Pretty much the inverse of April.

Thankfully, we have entered the blackout period ahead of the June FOMC, so there will be no policymaker noise for the next couple of weeks.

Equities:

Model has been bullish S&P and Nasdaq for a while now

After the April correction, markets marched on in May, with the S&P500 up +4.8% on the month, placing it up 10.6% YTD (11.3% including dividends).

Tech sector earnings continue to surge — in contrast to the index, and in contrast to global markets. It’s all riding on US big tech, they are the most expensive stocks and doing most of the work in taking the index higher, and they have the earnings growth to back it.

Digital Assets (aka crypto)

The model continues bullish on crypto majors: Bitcoin, Solana and Ethereum

There's been a seismic shift in the political landscape in the last two weeks. Pro-crypto has become the second bipartisan issue in the United States, along with anti-China. There are 90 million crypto owners in the United States. Bad-mouthing crypto is a stupid hill to die on in a tight election.

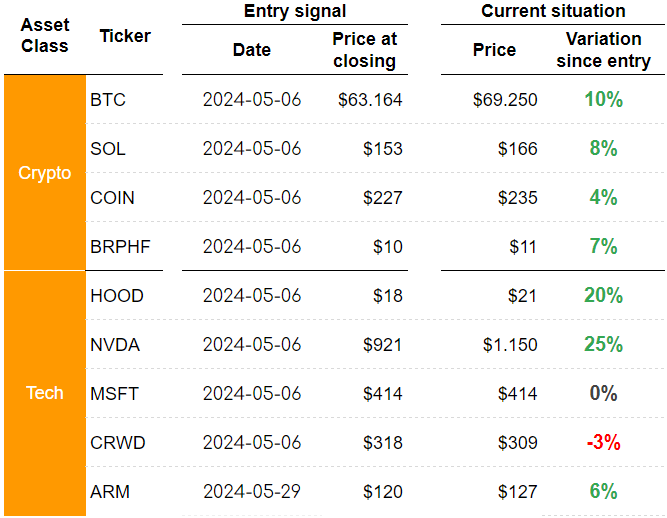

PORTFOLIO UPDATE:

Coming to portfolio positions no additions or exits this week. However, MSFT and CRWD are close to triggering an exit signal. We'll let you know when it happens

As you have probably noticed we are now only showing the variation since the buy signal was given as the total return was creating some frustration among subscribers who were not keeping up with total returns because of bet sizing.

LINK OF THE WEEK:

A man from Philly was determined to become rich. 30 years later, he built one of the best track record on Wall Street, making 30% a year for 30 years. Druckenmiller is one of the top traders ever.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.