Weekly Update #33: Jun 10 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

Macro:

The Bank of Canada and the European Central Bank (ECB) cut interest rates last week. It appears they are no longer concerned about mild inflation. Instead, they seem focused on reinstating a financial repression regime by allowing inflation to outpace yields for a longer period. This approach will debase public debt—and devalue your savings.

Financial conditions continue to ease, but it's uncertain how long this will last. We are beginning to see some headwinds, particularly with the strengthening of the US dollar.

While Treasury buybacks and the QT tapering programs have started providing more liquidity by lowering the 10-year yield, the US dollar is rising rapidly, acting as a counterforce in a clear risk-off move. This strength in the US dollar could derail the bullish narrative for the next month or so.

While we have not gotten a sell signal yet, momentum is significantly degraded across the riskON assets. If this continues, the Models will likely signal exits soon. We will send a note when it does.

Equities:

Model has been bullish S&P and Nasdaq for a while. Stock markets overall continue making new all-time highs but stay alert as momentum is quickly vanishing.

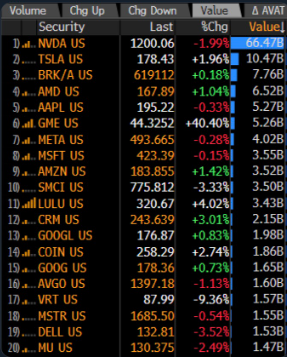

One of the recent model picks Nvidia has been on fire since the signal was sent. Up around 35% since. Its traded volume is getting crazier by the day. It´s now about as much as the rest of the top 20 traded equities combined... don´t fight the tape.

Digital Assets (aka crypto)

The model continues bullish Bitcoin and Solana but momentum is quickly vanishing across crypto assets, stay alert. All the setups were pointing towards a summer breakout and we would have loved it but we need to respect the data as it unfolds.

PORTFOLIO UPDATE:

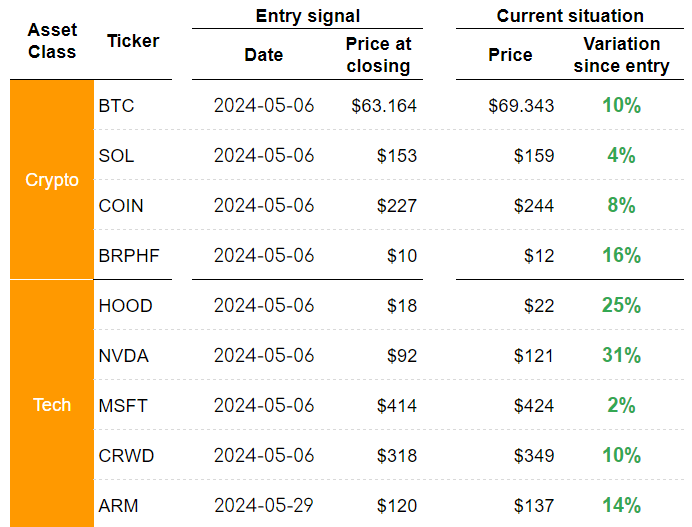

Coming to portfolio positions no additions or exits this week. Overall positions are performing pretty well, specially HOOD and NVDA with returns over 25% since the signal was sent.

LINK OF THE WEEK:

Very useful and pragmatic short video from Jason Shapiro, one of the market wizards from Jack Schwager´s great books.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.