Weekly Update #16: Feb. 12 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

Mid-last week, financial conditions finally eased as the US dollar and yields fell following comments from Yellen. Risk assets surged, much like beachballs bursting out from underwater. Keep in mind that financial conditions drive liquidity, and liquidity drives asset prices.

Yet, there's no indication of a turnaround in any of the financial condition elements: US dollar, rates, and oil. So, stay on your toes and follow the simple (yet not easy) set of guidelines:

- Don´t predict. React.

- Don't rely on opinions; instead, track price action. If you think you're outsmarting the market, you're likely to get burned.

- Follow a clear set of rules. Systematic investing always beats discretionary approaches. That is critical to protect you from yourself and your emotions.

- Manage risk: cut losers, ride your winners

Equity:

S&P breached the historic 5,000 level. Euphoric sentiment regarding artificial intelligence amidst a bottomless appetite for tech stocks continues to push equities higher.

The model continues to be bullish on both the S&P and the Nasdaq.

Note: the oscillating line depicted on the graphs is one of our primary indicators. While it's not our entire system, it certainly plays a crucial role. The vertical lines indicate its buy and exit signals.

Digital Assets (aka crypto):

Crypto is looking bullish. Crypto stocks are looking really good too. There is no change in view to what was mentioned in the quick mid-week update.

The crypto market is looking increasingly good. Today the model went long BTC and Solana.

Since we published the crypto buy signal on Wednesday:

- Bitcoin and Solana are up around 12%

- BTC Miners (CLSK and MARA our main bets) are up over 50%

- Galaxy Digital (BRPHF) is up 27%

Always good to see that the model is working well. It caught the reversal in this case.

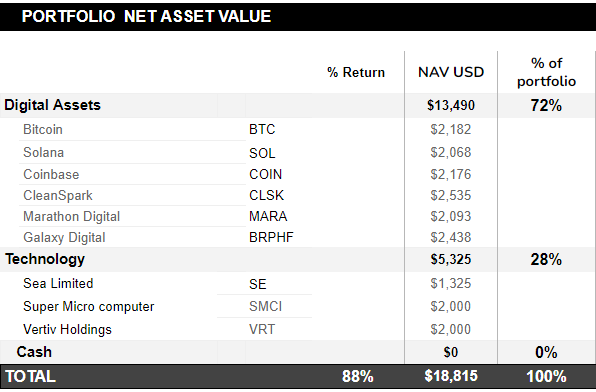

PORTFOLIO UPDATE:

Coming to portfolio positions.

Following the model's buy signal, we placed our crypto bets on Wednesday.

On the equity side, we opened a position in SE on Wednesday too and we are about to open a position at today´s opening in pure AI names such as SMCI and VRT. One does the servers where NVDA AI chips are installed, the other does the cooling gel to keep those servers working. We didn´t catch the turning point on those stocks as we did not have them on our radar but we are happy to open the position in a less-than-ideal setup as the model is showing a lot of strength on those names.

Last week's bets are performing well. We started the portfolio with $10,000 on October 20th 2023, and we are up 88% since.

Higher, together!

LISTEN OF THE WEEK: Adam is bringing a fantastic lineup lately. Grant is a great big-picture thinker, even though I do not share his trading approach. Enjoy!

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.