Weekly Update #17: Feb. 18 2024

Thanks again for signing up! Our missing is to help as many people as possible with this newsletter. If you enjoy our content and find it valuable, please reward our efforts and help us spread the word by sharing it with your friends, family and colleagues.

With that said, let´s dive right in...

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

Not much has moved this week, so we´ll spend some time explaining our big-picture view as that might help you get more conviction in some of the proposed trades and impact how you size your bets.

We are so bearish on the state of affairs that it makes us bullish on risk assets. The rate hikes we got sold as tightening measures, are stimulatory for the economy as they contribute to a larger deficit. "Higher for longer" on 34 trillion government debt increases deficits non-linearly while constricting private sector output which we believe will drive a fed-induced version of what happened in COVID.

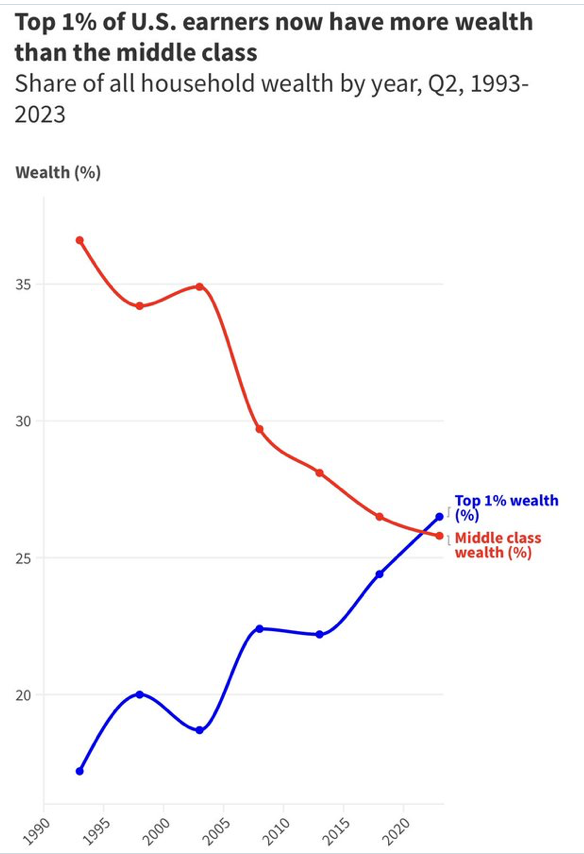

Central banks are literally making fun of us. Watch the clip below where New Zealand Governor of the Reserve Bank, Adrian Orr, says central banking is "a great business to be in, where you can print money and people believe it". All his colleagues laugh at his statement. These guys are so disloyal to the citizens they should be working for. Their entire careers have been about destroying middle-class families. The trend has been the same no matter what party is supposedly in charge.

When a system benefits a few at the expense of many, those in power usually protect that system and obscure the reality to continue. If you are not one of the privileged few, you can opt out with Bitcoin and other digital assets ... that´s why it was invented.

Equity:

Momentum is slowly vanishing, financial conditions continue to tighten, trend exhaustion signals start to pop up and non-favorable seasonality indicates we could be drifting lower over the coming couple of weeks... keep your eyes wide open and tight your risk management.

Digital Assets (aka crypto):

There is no change in view to what was mentioned in last week's update. Model continues to be bullish.

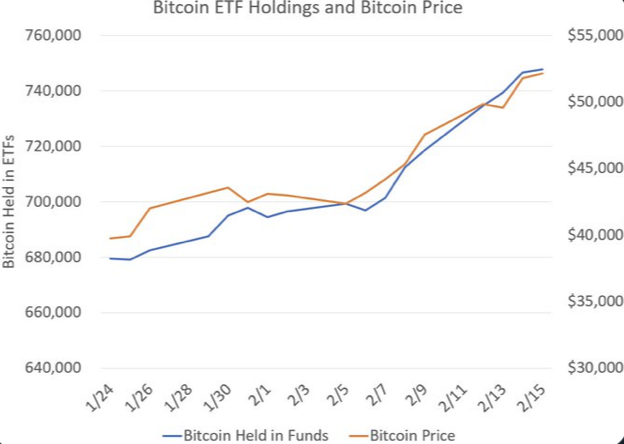

Prices are set on the margin and both demand & supply matter. The Halving is in 2 months. After that, there will be 450 bitcoins mined per day while ETF flows are beyond the wildest dreams of even the most bullish analysts. ETFs are sucking up approximately 10k BTC a day. Do you see what´s about to happen? All we can say about crypto today is… don’t overthink it.

PORTFOLIO UPDATE:

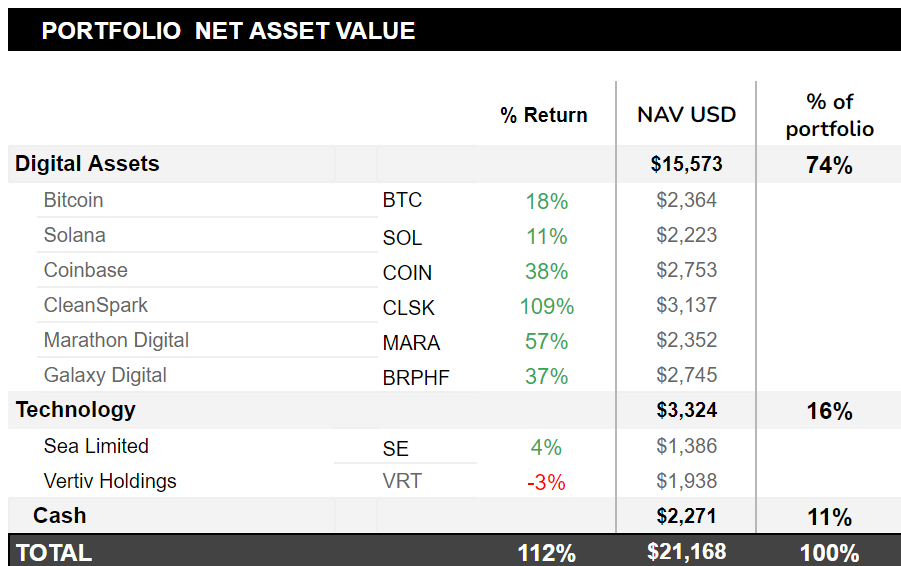

Coming to portfolio positions.

On the equity side, the ugly price action following SMCI CEO comments on Friday, triggered our stop loss. Good thing is that we ended the trade with +14% profit. All other position remain intact and performing well.

We started the portfolio with $10,000 on October 20th 2023, and we already more than doubled our investment capital since. We are up 112%.

Higher, together!

LISTEN OF THE WEEK: Justin is one of the more knowledgeable guys in the uranium trade and we are keeping an eye on to find a good entry. Enjoy!

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.