Weekly Update #18: Feb. 25 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

After 2 months of tightening financial conditions, there seem to be some initial signals that point to a trend reversal. The US dollar and the 10-year rates look like they are topping and if the trend reverses that should be very positive for liquidity and risk assets performance.

Equities:

Last Wednesday, Nvidia posted a spectacular earnings report, with revenue more than tripling year over year, driving the Nasdaq and the S&P up.

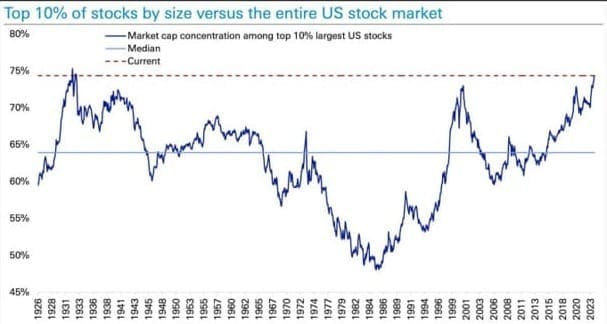

Signs of trend exhaustion are popping up. Market breadth (figure below) is getting stretched as well, reaching levels only seen during the peaks seen in 1929, 2000 and 2021. However, the model continues to be long the SP500 and the Nasdaq, so the path of least resistance is still up for now.

Quick note: We started liking some Chinese stocks as they are cheap, their central bank is cutting rates, and no one seems to be interested in China right now. We are monitoring a potential entry in PDD, I´ll keep you posted on any news.

Digital Assets (aka crypto)

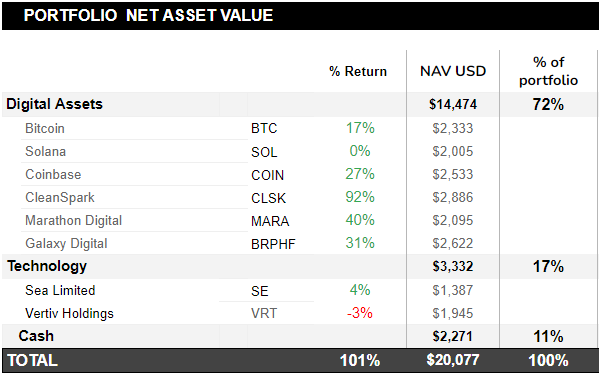

The model continues to be long BTC, Solana and ETH.

ETF inflows are slowing down, and we're noticing some signals indicating trend exhaustion. It looks like we will see a bit more downside or chop. But, who knows? Right now, sentiment is bearish, with many anticipating a significant correction. While that's certainly a possibility, it's worth noting that throughout this bull market, every time it seemed poised for a downturn, it's managed to surprise everyone by bouncing back up instead, catching many off guard.

COIN, CLSK (miner), MARA (miner) and Galaxy Digital continue to be our cycle picks and we will use any dip to accumulate positions.

Commodities:

We're keeping a close eye on both gold and silver charts, ready to make a move once the breakout occurs, although it seems they're not quite there yet. When it comes to betting on the metal prices, I prefer miners as they offer greater upside potential. Think of them as leverage plays on the metals.

PORTFOLIO UPDATE:

Coming to portfolio positions. There have been no entries or exits this week .

We started the portfolio with $10,000 on October 20th 2023, and we are up 101% since.

LINK OF THE WEEK: This week, we're excited to highlight a fantastic post by Ben Hunt, packed with valuable insights for parents. It's definitely worth checking out!

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.