Weekly Update #19: Mar. 4 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

No change in views.

The US dollar and 10-year rates sustained their downward trend for the second consecutive week, a development that was very positive for liquidity and risk assets.

After 2 months of tightening financial conditions, there seem to be some signals that point to a trend reversal.

Equities:

The model continues to be bullish on the SP500 and the Nasdaq. So bull market until further notice. All greed no fear.

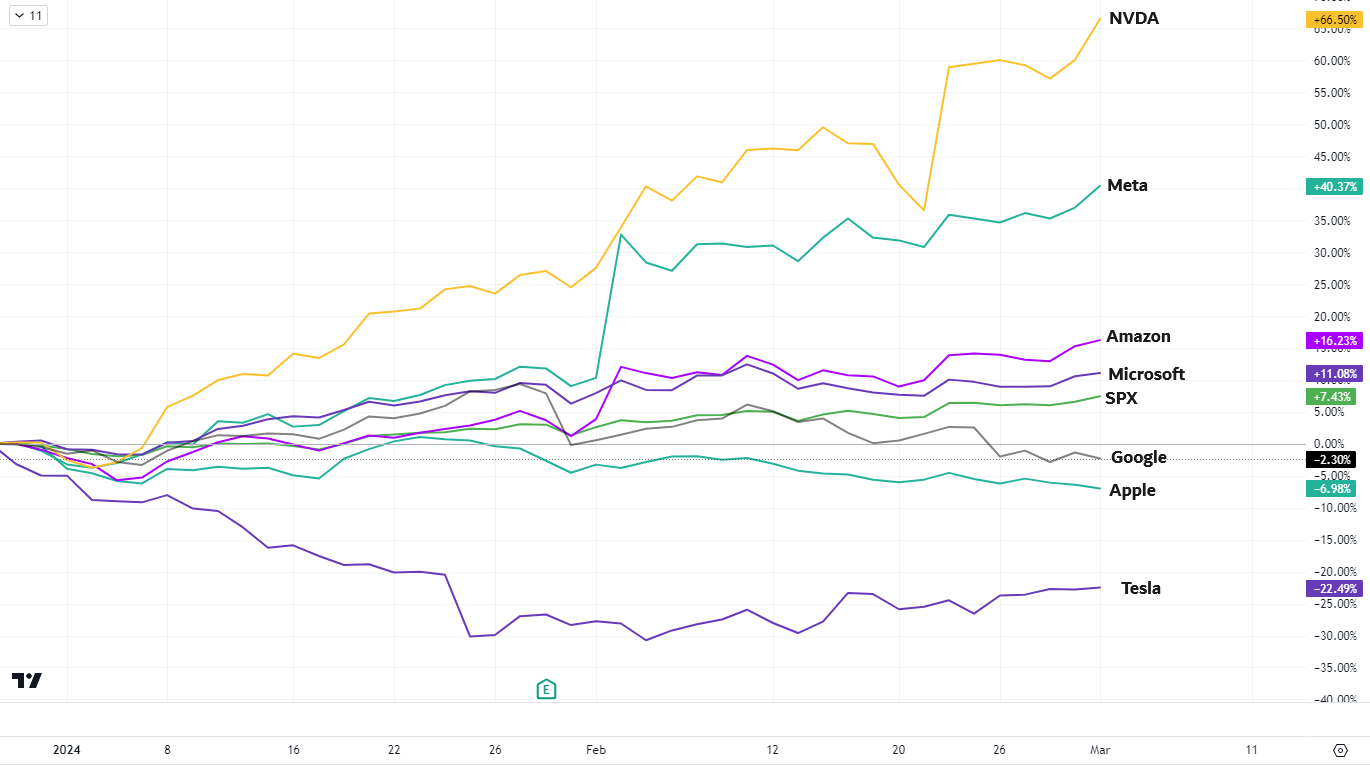

However, there are emerging signs of exhaustion in the trend, and market breadth appears stretched, even among the usual market leaders. Notably, Tesla peaked in July 2023, followed by Apple and Google in February, and now Microsoft fails to reach new highs despite the recent market upsurge. What was once the "Magnificent 7" of 2023 has now dwindled to the "Magnificent 3" of 2024: Nvidia, Amazon, and Meta.

The Nasdaq might be an overvalued bubble but it´s hard to make the case it is over-owned right now. The market is not crowded on the long side yet, so more room to go higher.

Digital Assets (aka crypto)

We have been bullish for a while and it's been playing out pretty well. Model longs have been on fire.

Majors BTC ETH SOL have had another phenomenal weekly close. The stage is set for an all-time high on all of them. We could be getting there soon.

Bitcoin is up 32% since the record-breaking ETFs launched last month and it looks as if the bull cycle´s just getting started.

Crypto funds have seen record yearly inflows just two months into 2024 and a few weeks away from halving.

Commodities:

Besides silver, we are also looking at the uranium correction to put a position back whenever we get sufficient signals to know that the correction phase is over. Not there yet.

PORTFOLIO UPDATE:

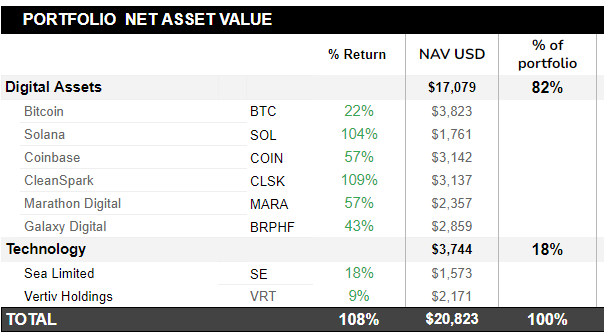

Coming to portfolio positions. There have been no entries or exits this week. We however deployed the cash increasing our Solana and BTC position on the recent breakout. We just want to be fully allocated.

We started the portfolio with $10,000 on October 20th 2023, and we have more than doubled the initial investment since.

LINK OF THE WEEK:

This week, we bring a quick post by Ray Dalio on the current stock market valuation.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.