Weekly Update #13: Jan. 28 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

We´ve experienced some weeks of choppiness. The good news? We were prepared for it and hopefully, we take advantage of this correction to rebalance our portfolios.

Brace for a period of choppy market in the upcoming weeks while financial conditions persist in siphoning liquidity from the market.

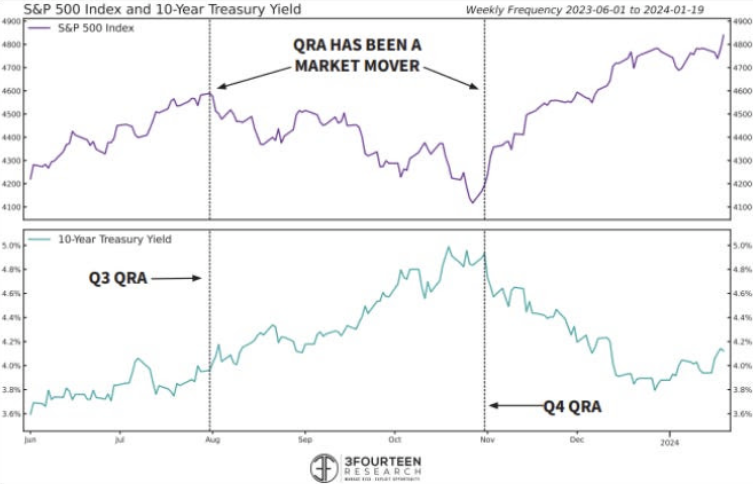

The US Treasury Quarterly Refunding Announcement is the most important policy announcement next week. If they keep a high proportion of bills vs. bonds as they have done in the last QRA, it´s good for market liquidity. If on the other hand, the Treasury goes for a relatively high proportion of bonds as they did in Q3 2023, they will push yields higher, sucking liquidity from the markets. I do not know what they will be doing but whatever they do will have an impact on liquidity, and move markets meaningfully. Up or down.

Equities:

All the stocks went up this week, except Tesla. The rally is mainly driven by strong tech earnings and economic stimulus but remains sensitive to monetary policies, currency shifts, and political developments.

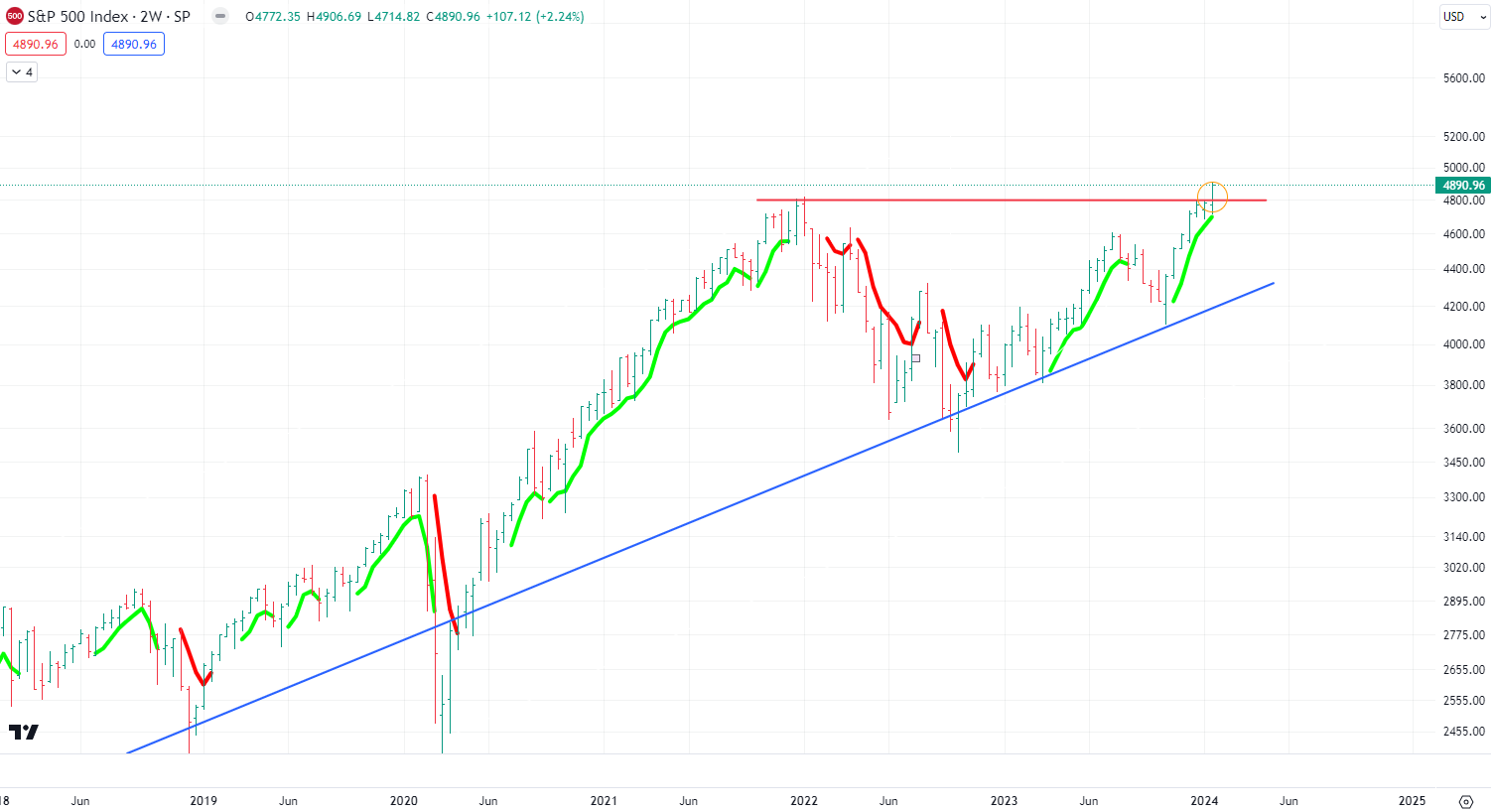

While the S&P500 and Nasdaq are holding up well at all-time highs, the model is still bullish on indices but market breadth has deteriorated and caution is advised.

Crypto:

The market is destined to encounter dips on the path to the halving; it's unavoidable. A glance at the charts reveals a consistent pattern in all previous pre- and post-halving cycles. Bitcoin tends to undergo multiple casual 20%, and 30% dips during the bull phases of the cycle, followed by swift recoveries. That is why it is so difficult to trade this asset.

Remember, it can get choppy during the next few weeks but the next Bitcoin halving is in less than 100 days and the event usually brings returns between x5-x10 in the next 18 months. It has already done it 3 times in the past and I do not see why this time will be different.

Is now the time to buy the dip? It’s impossible to know the future but in a bull market, dips are buying opportunities, and expecting perfect timing isn’t feasible. This could still be a relief rally and we could have another leg down to 36K in Bitcoin but what if it's not? and we get a ripper (I'm leaning toward this scenario at the moment as we have had a strong weekly close). we need to be open to both scenarios and be data-driven.

How to play this is the real question. If you believe in the asset class as I do KEEP YOUR CORE POSITIONS AS THEY ARE until the model turns bearish.

PORTFOLIO UPDATE

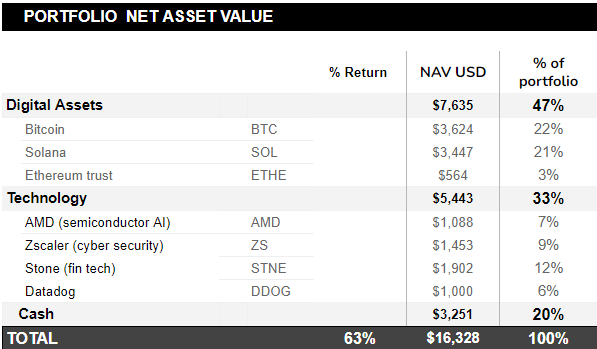

Coming to model positions. There are several movements on the portfolio this week. We are using the market weakness to reshuffle the portfolio and concentrate the bets on the stronger names where we also have higher conviction.

On the crypto side, we exited our GBTC position. The model is not bearish in GBTC but now that the ETF approval is a fact and the valuation gap closed, there is no reason to stick with that vehicle and we prefer to hold the coins instead, avoiding high management fees. We´ve used the proceedings to increase our positions on the stronger names: Bitcoin and Solana

On the equity side, we exited Dexcom and got into DDOG. We are also watching SNOW and ESPO where we might get a good set-up during the week.

We started the portfolio with $10,000 on October 20th 2023, and we are up 63% since!

Note: I took out the % return column from the individual names to keep it simple as we have several buys.

LISTEN OF THE WEEK: Andy Constan on his holistic approach to trading the markets. Enjoy!

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.