Weekly Update #12: Jan. 21 2024

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

As foreseen by the model, we find ourselves amidst a volatile environment that may persist for several weeks, driven by a stronger dollar, higher interest rates, and higher oil prices. Once again, brace for a period of choppy market in the upcoming weeks while financial conditions persist in siphoning liquidity from the market.

The model anticipates a pause in the downward trends of the US Dollar, Oil and Interest Rates. Curiously enough, this shift comes when seasonal patterns also suggest some shakiness in Q1, followed by a major rally later on. So, stay on your toes.

It´s in general a good time to de-risk your portfolio and prepare to take advantage of marker weaknesses and add on your high-conviction selections when the time comes.

Equities:

Stocks recovered from the worst start of the year since 2008. and both the Nasdaq and SPX are closing the week at all-time highs. Trend exhaustion signals continue to show up and caution is advised but let´s not ignore that we are at all-time high.

Crypto:

We finally got the formal Bitcoin ETF approval last week! By all measures, the spot Bitcoin ETF has been a massive success, yet some ‘experts’ want to call it a failure because price isn’t going up immediately. It’s going to take time for ETF inflows to materialize in recognizable price swings. Funds are shuffling around, and investors are just getting warmed up to these products. Big things are coming, it just requires a bit of patience... and stomach.

The ETH exit signal ended up being a false signal as anticipated. The model is still bullish on Bitcoin, Solana and Ethereum. However, we are seeing momentum losing steam and more downside or at least a lot of chop is likely. At this point, we still do not know if it´s just a correction or if the uptrend is broken. Stay tuned

The model signaled an exit in Ethereum but not in Bitcoin or Solana yet. It could be a false signal but it still worth paying attention to.

Remember, it can get choppy during the next few weeks but the next Bitcoin halving is in less than 100 days and the event usually brings returns between x5-x10 in the next 18 months. It has already done it 3 times in the past and I do not see why this time will be different.

PORTFOLIO UPDATE

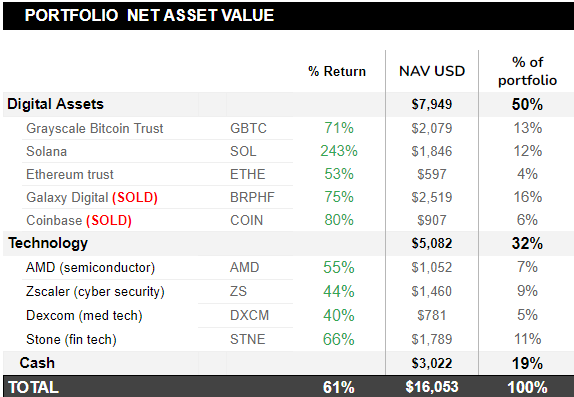

Coming to model positions. There are no new entries and 2 exits as we got stopped out from our Galaxy Digital and Coinbase positions. We still like very much those names but we play following the model rules.

We started the portfolio with $10,000 on October 20th 2023, and all our positions are up at least 40% since!

LISTEN OF THE WEEK: Luke is one of my favorite big-picture thinkers. I also share his hair style. Enjoy!

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.