Weekly Update #11: Jan. 8 2024

Happy 2024 and welcome back to the No Rainy-Day portfolio!

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

A great end to 2023 has given way to a lousy start to 2024. The easing of financial conditions since October has been a tailwind for our portfolio positions, however, the model anticipates a pause in the downward trends of the US Dollar, Oil and Interest Rates.

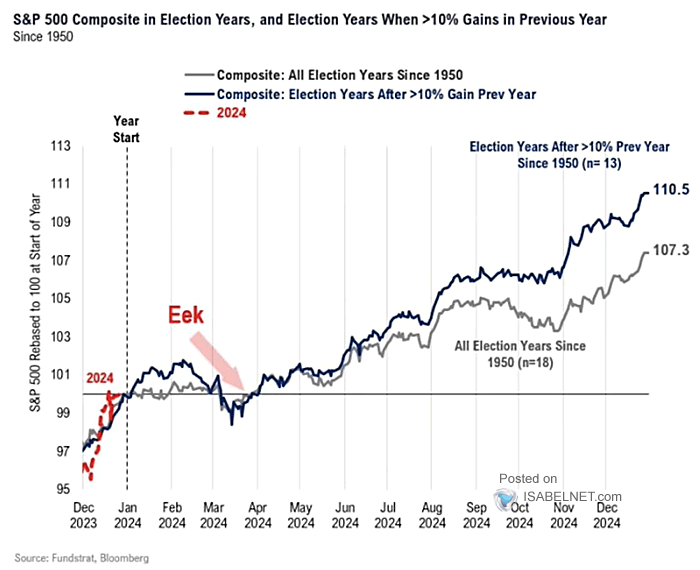

Curiously enough, this shift comes when seasonal patterns also suggest some shakiness in Q1, followed by a major rally later on. So, stay on your toes. Those of you who did not participate in this leg-up get ready as you might get a good entry point sometime in Q1 or early Q2.

Equities:

Stocks had the worst start of the year since 2008. Additionally, the model is sniffing exhaustion of the Nasdaq up-trend and signals that risks are increasing rapidly and we should get more defensive.

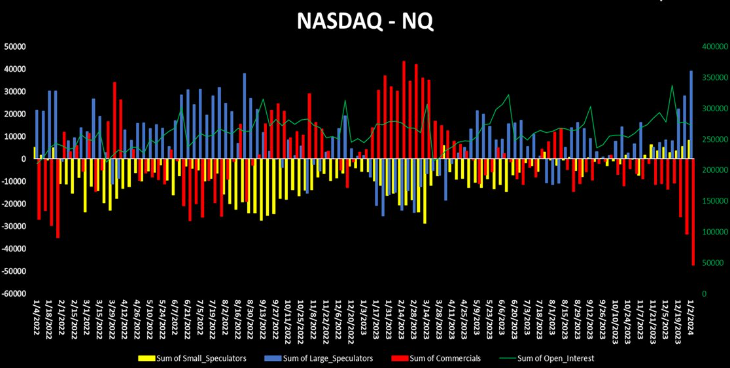

Speculators positioning on the long side is also getting crowded fast (based on the Commitment of Traders report, see graph below). Everybody and their mother is now long in the futures market ... not a lot of buyers left.

Crypto:

There are all indications that we could be getting the formal Bitcoin ETF approval this week and that is a piece of excellent news for the space as it reduces significantly the government prohibition risk.

BTC has barely corrected however, Solana went down 20%+. While in hindsight, it is very easy to tell yourself that you should have booked profits, these could have easily done another 50% without breaking a sweat. If you entered close to the newsletter buy signal, you´ll probably have some decent profits by now.

The model signaled an exit in Ethereum but not in Bitcoin or Solana yet. It could be a false signal but it still worth paying attention to. A lot of data points suggest that ETH's position as a dominant Layer 1 is getting seriously challenged by Solana.

PORTFOLIO UPDATE

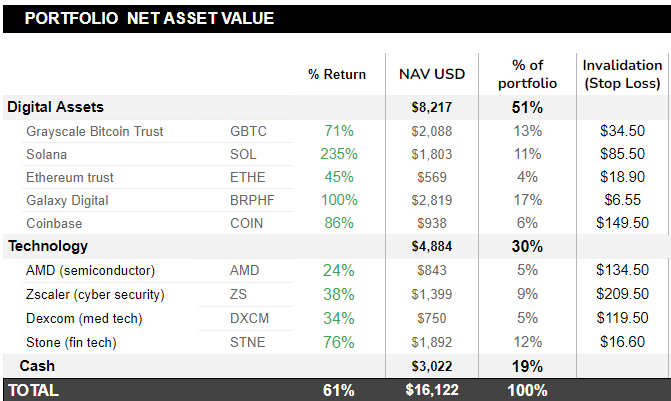

Coming to model positions. There are no new entries and a some exits: GSVRF IE and COPX.

As risks are emerging, we are tightening our stop losses to make sure profits do not fly away. If we are still in an uptrend we should be making higher lows and higher highs, so we will get out if price action breaks down the last swing low (see invalidation levels on the table below to get full visibility on the levels we are watching).

We are not actively booking profits as that is usually not our style but it could be very OK to do so now... Nobody has ever lost money by taking profits.

We started the portfolio with $10,000 on October 20th 2023, and the net asset value is up 60%+ since!

LISTEN OF THE WEEK: Adam is becoming quickly one of the best financial interviewers out there. He got the most out of Jim Rogers (co-founded with G. Soros the Quantum Fund (G. Soros investing vehicle). Take note of what Jim thinks vs what he trades.

That’s it from us this week, thanks for reading!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.