Weekly Update #4: Nov. 10 2023

Welcome back to the No Rainy-Day portfolio!

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

Not much has changed since last week. Crypto is definitely back, the Nasdaq 100 broke out from a bull flag and started a rally. The path of least resistance is up, especially now in November and December.

Something has been intriguing me for quite some time now... How is it possible that the US economy appears so resilient despite central banks hiking rates further and faster than at any time in modern history? US GDP grew in Q3 at the highest rate since 2021.

We looked back at the tightening episode that led to the great financial crisis to find similarities and differences that could explain current developments. In 2008, families were highly indebted, and mostly financed at variable rates. Once rates went up, mortgage defaults spiked, with a domino effect on banks.

The situation is quite different today:

- Households are mostly unaffected yet, thanks to their relatively low debt level and an increased prevalence of fixed-rate mortgages.

- Corporations are largely unaffected too. Despite some problematic interest-sensitive sectors like commercial real estate and banks, the average corporate debt level is low and the average duration is substantial.

- The US government is taking a hit as it´s highly indebted and needs to refinance 50% of its debt at much higher rates in the next 24 months. Unlike most households and companies that took advantage of the 2020-2021 period to refinance their debt and secure low-interest rates, the government did not. Probably one of the biggest mistakes ever made by the US Treasury.

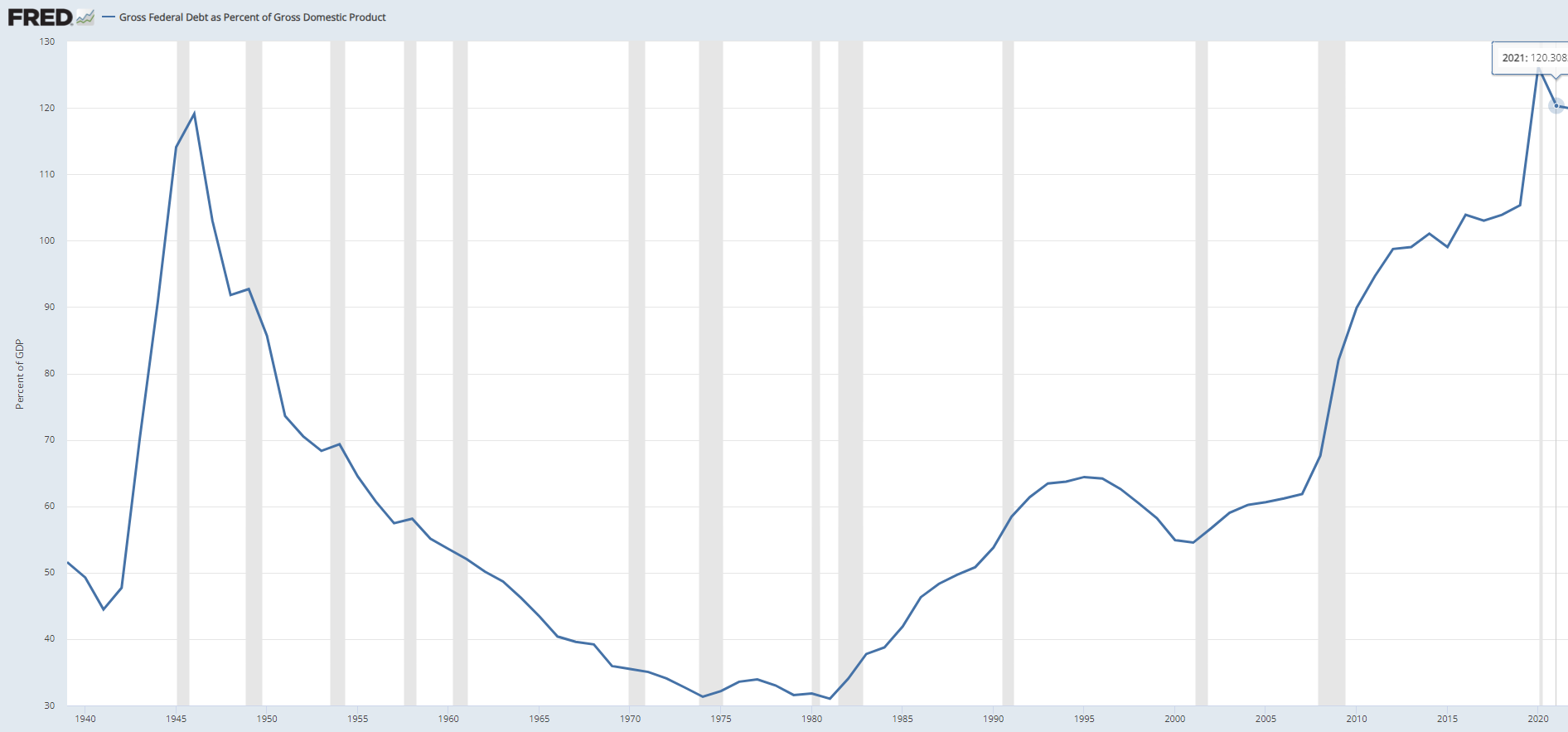

The federal debt currently exceeds 120% of the GDP. The last instance of the United States grappling with such a high level of public debt was during the conflict with Germany eight decades ago. What is particularly alarming beyond the magnitude of the federal debt is its rapid expansion, registering an annualized growth rate of 18.5% since June.

Gross Federal Debt as a Percent of GDP

In the short term, having governments spending as "drunken sailors" is of course stimulative for the economy. US GDP is growing at 4.9% because the US Government is running a deficit equivalent to 6.2% of GDP!

There is however a cloudy horizon, as no easy solution for the deficits. Taxes would need to rise and public spending would need to be cut in such a way that the resulting slump in tax revenue doesn´t offset it. Probably not going to happen in the current political atmosphere.

So, what are the dangers for your portfolio? Probably a mix of currency debasement, inflation, financial repression and geopolitical instability. The best protection against that potential fiscal spiral is uncertain but it likely involves owning a combination of things that central banks cannot print like bitcoin, hard assets or profitable technology. And if you can choose, choose to just participate when they go up!

THE NO-RAINY DAY PORTFOLIO

Coming to portfolio positions.

There have been no portfolio purchases or sales this week, we just went to ride the model picks.

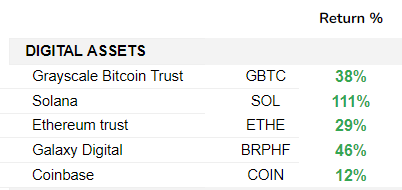

The model's bets have been up nicely since they were published, especially crypto ones. As we mentioned last week we will be prudent in adding positions here as there are some signs of trend exhaustion. However, momentum is still very strong and cryptos tent to surprise to the upside.

The Nasdaq and the "Big 7" look bullish. Microsoft already broke out and is making a new record all-time high.

Commodities still hold strong momentum, despite a soft week driven by a strong US dollar,

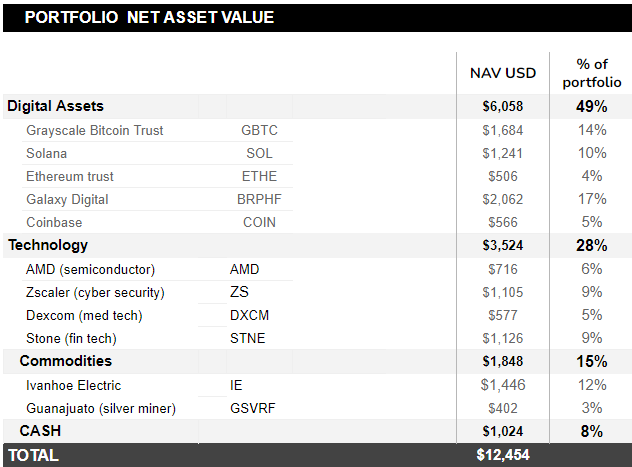

Net Asset Value is up 25% in one month -since inception-, in the same period the Nasdaq 100 - our benchmark- grew 3%. The model has definitely been delivering some alpha.

That’s it from us this week, that was 3 minutes.

Thanks for reading and good luck out there! Please feel welcome to share this with friends and colleagues

LISTEN OF THE WEEK: THE MOVIE MAN

Enjoy!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.