Weekly Update #3: Nov. 05 2023

Welcome back to the No Rainy-Day portfolio!

You may have noticed a subtle change in our branding. As a response to unforeseen issues, we've embarked on a quick rebranding. Rest assured, this doesn´t change our commitment.

We have 3 minutes, so let’s dive in...

WHAT YOU NEED TO KNOW ABOUT MARKETS THIS WEEK

FINANCIAL CONDITIONS: The tightening of financial conditions has reached a peak: interest rates, the US dollar and oil are all turning down. By the way, it´s really surprising to see oil down with the Middle East conflict going on ... is there some demand weakness that is starting to show up, prelude to a recession?

Fed Chair Jay Powell spoke last week. The more he spoke, the more the market understood that the US central bank is done with rate hikes. Look at how the US 2-year yield plunged by the minute during his presentation.

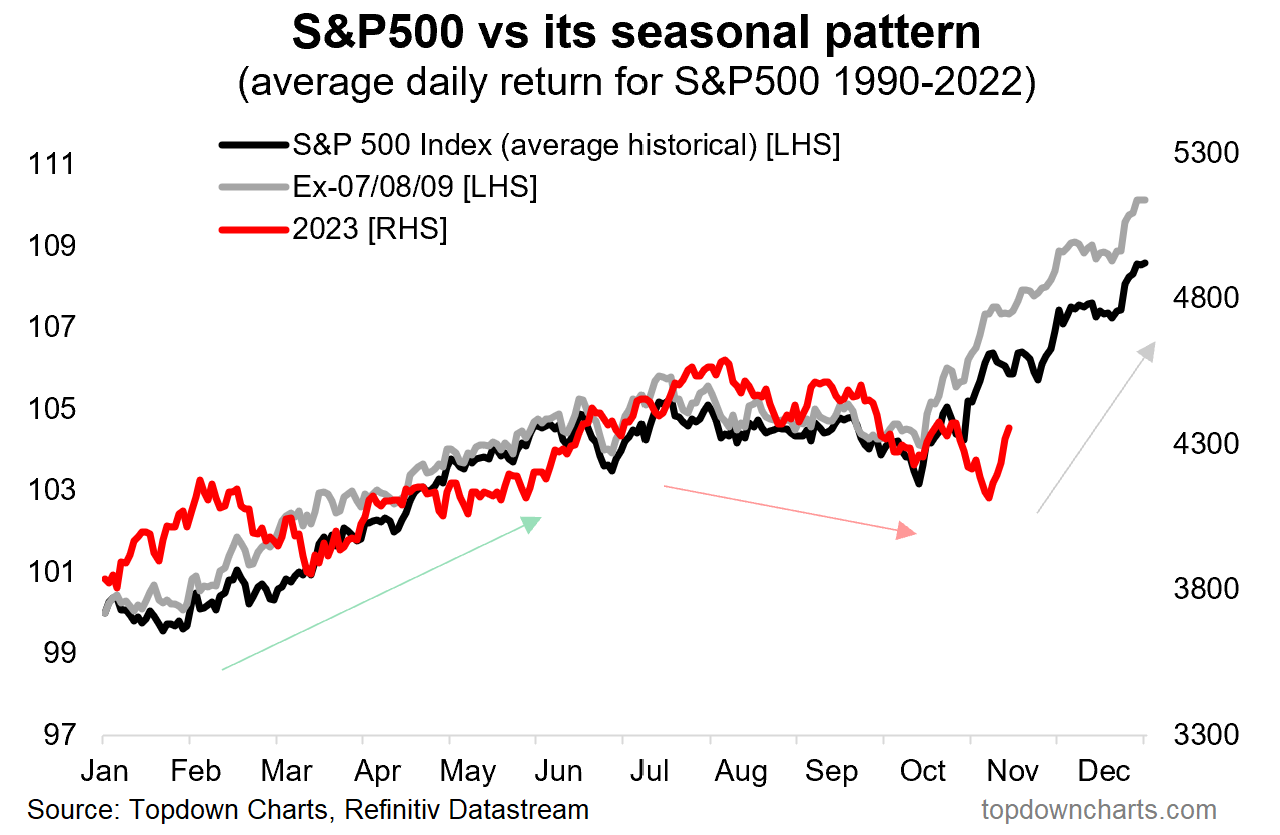

STOCKS: At the same time, the Nasdaq went ballistic and staged its biggest relief rally since Nov 22 (+6.6% week-over-week). Last week decidedly set a bullish tone. Additionally, there is positive seasonality coming in November and December with a potential Santa rally on the cards. The model hasn´t yet turned green on the general index but some of its components look already poised to go up.

DIGITAL ASSETS: The model has been very bullish on the digital asset space since launching this newsletter. However, it has now started to send signals of potential up-trend exhaustion. That fact coupled with substantial overhead resistance in the 40k$ to 48k$ range makes a consolidation likely in the short term. Prudence is advised.

THE NO-RAINY DAY PORTFOLIO

Coming to portfolio positions.

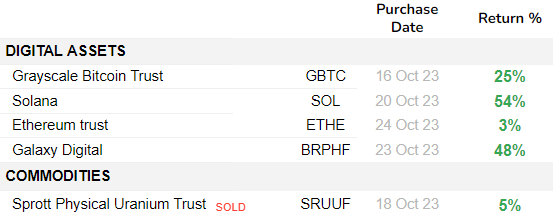

The model's bets have been up nicely since they were published. Although the model was still bullish on uranium it has closed its Sprott Uranium Trust position as new entries showed greater relative strength

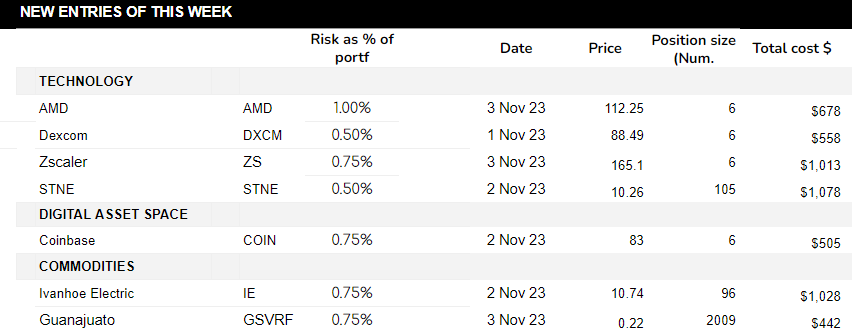

We have continued to deploy capital as some opportunities started to pop up both in tech stocks and commodities. The new portfolio entries for this week are:

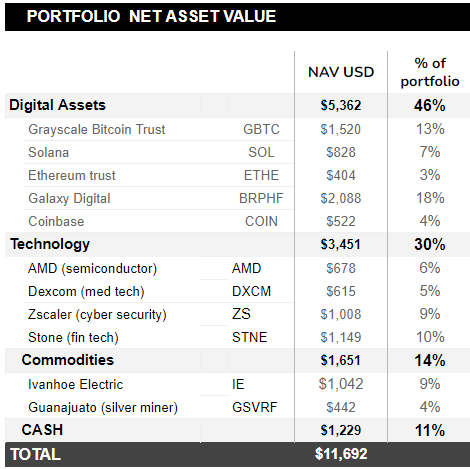

Portfolio Net Asset Value is up 17% since inception, in the same period Nasdaq grew 0%.

That’s it from us this week, that was 3 minutes.

Thanks for reading and good luck out there! Please feel welcome to share this with friends and colleagues

LISTEN OF THE WEEK: TWO OF THE BIGGEST LEGENDS CHATTING

Enjoy!

DISCLAIMER: The No Rainy-Day Portfolio is not registered with any financial regulatory agencies. Content is for research, education, and entertainment purposes and should NOT be considered personalized financial advice.